Navigating the Tax Landscape for Small Businesses: A Roadmap to Success

Let's Explore

For small business owners, understanding the complexities of the tax landscape is essential for financial stability and growth. Navigating the intricate web of tax regulations can be challenging, but with the right roadmap, you can optimize your business's tax strategy. In this blog post, we'll explore key considerations and strategies to help small businesses thrive in the ever-evolving tax environment.

1. Know Your Business Structure

"The hardest thing in the world to understand is the income tax." -Albert Einstein

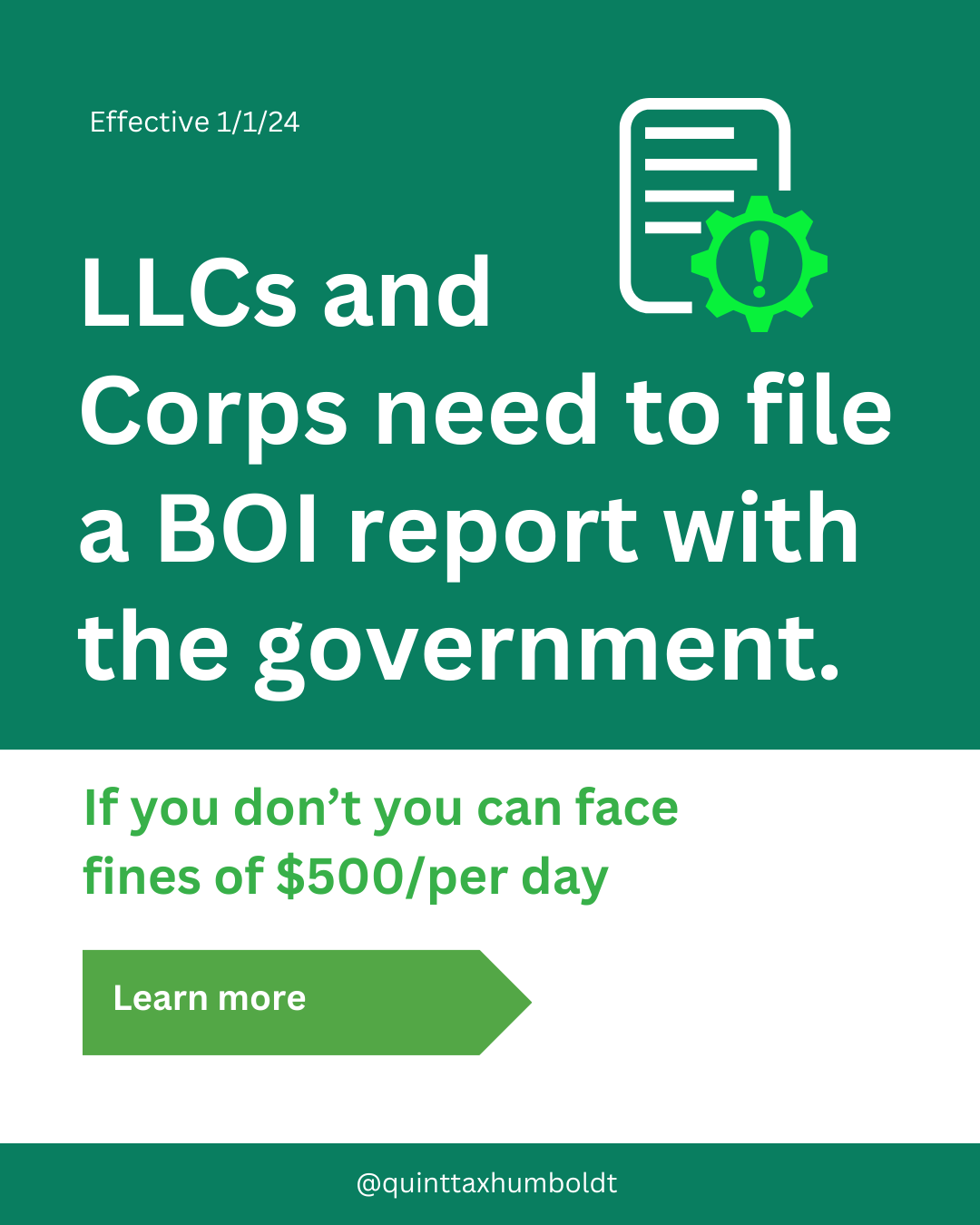

The first step in navigating the tax landscape is understanding your business structure. Whether you operate as a sole proprietorship, partnership, LLC, or corporation, each structure comes with its own tax implications. Familiarize yourself with the tax obligations associated with your specific business type to ensure compliance and identify potential opportunities for tax savings.

2. Leverage Business Deductions

One of the advantages of running a small business is the availability of various business deductions. From operating expenses to depreciation on business assets, identifying and claiming eligible deductions can significantly impact your bottom line. Keep meticulous records of your business expenses to maximize deductions and reduce your taxable income.

3. Explore Tax Credits

Tax credits are powerful tools for small businesses, offering a direct reduction in the amount of taxes owed. Research available tax credits for small businesses, such as the Small Business Health Care Tax Credit or the Work Opportunity Tax Credit. Taking advantage of these credits can provide valuable financial relief and support your business's growth.

4. Stay Informed on Tax Law Changes

Tax laws are subject to frequent changes, and staying informed is crucial for small business owners. Regularly check for updates on tax regulations that may impact your business. Consider consulting with a tax professional who can provide insights into changes relevant to your industry and help you adapt your tax strategy accordingly.

5. Maintain Accurate Financial Records

Accurate financial records are the backbone of a successful tax strategy. Implement a robust accounting system to track income, expenses, and transactions. This not only simplifies the tax preparation process but also provides a clear picture of your business's financial health. Cloud-based accounting software can streamline record-keeping and enhance accessibility.

6. Seek Professional Guidance

Navigating the tax landscape can be overwhelming, especially for small business owners managing multiple responsibilities. Engaging the services of a qualified tax professional or accountant can provide invaluable support. A professional can help you navigate complex tax issues, ensure compliance, and identify opportunities for tax optimization.

Conclusion

Successfully navigating the tax landscape is a critical aspect of small business management. By understanding your business structure, leveraging deductions and credits, staying informed on tax law changes, maintaining accurate financial records, and seeking professional guidance, you can create a roadmap to tax success. Empower your small business with a strategic approach to taxation, unlocking opportunities for growth and financial prosperity.