The Beneficial Ownership Information Reporting Rule for Businesses

What you need to know about filing the BOI and avoid hefty penalties

LLCs and Corps need to file a BOI report with the government. If you don’t you can face fines of $500/per day.

What is it?

The Corporate Transparency Act mandates a new reporting requirement called the Beneficial Ownership Information Reporting Rule, overseen by FinCEN, a branch of the U.S. Department of the Treasury.

This rule enhances transparency in company ownership and aids the federal government in combating various financial crimes and fraud, aligning with ongoing efforts to deter corporations from engaging in harmful actions while hiding their involvement or reaping benefits.

When to Report BOI?

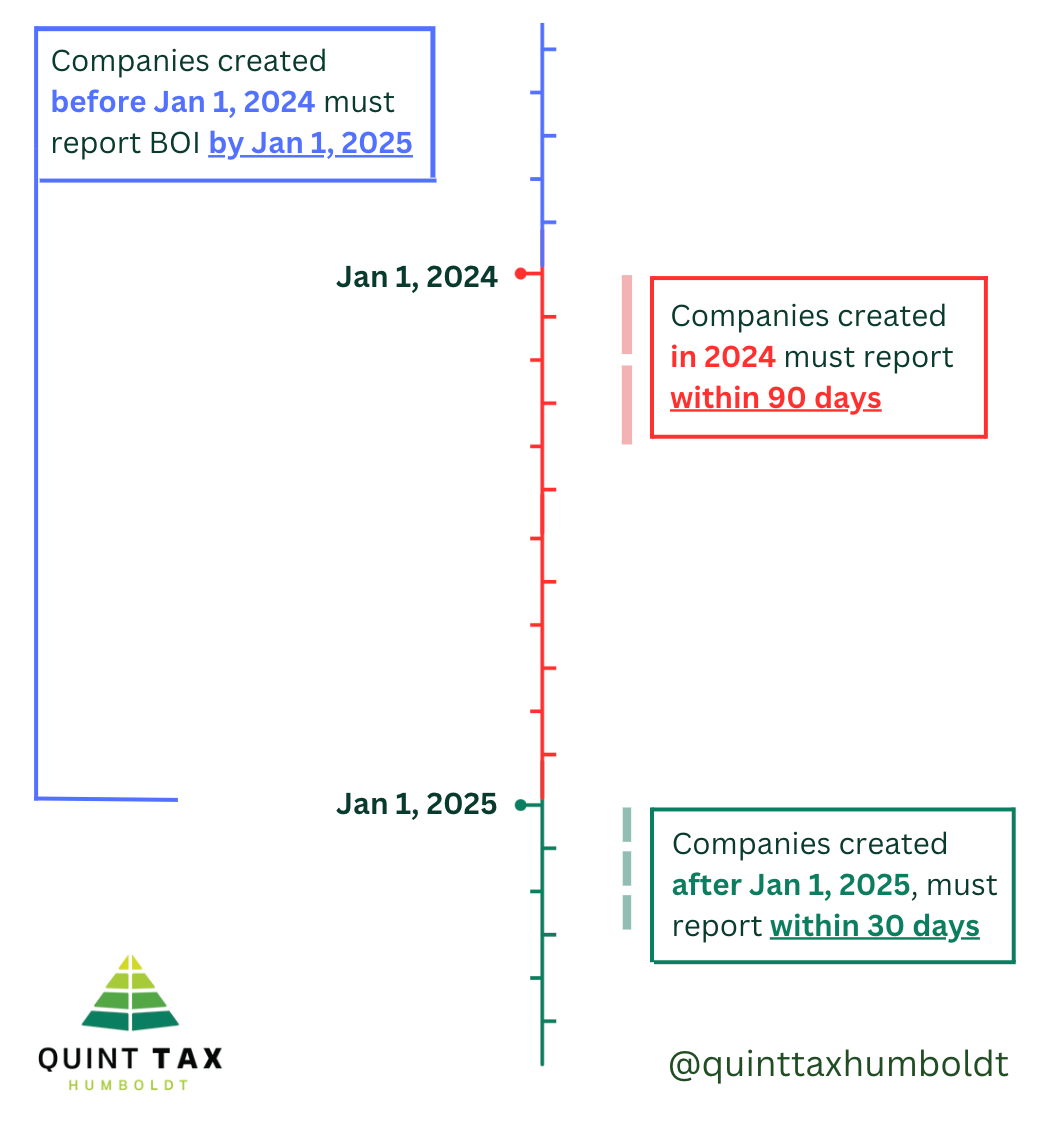

FinCEN began accepting reports on January 1, 2024.

- If your company was created before January 1, 2024, you have until January 1, 2025 to report

- If your company is created in 2024, you must report within 90 days

- If your company is created on or after January 1, 2025, you must file BOI within 30 days

- Any updates or corrections must be submitted within 30 days.

How to Report

Report your BOI FinCEN’s website: www.fincen.gov/boi

OR

For ease and peace of mind, hire a tax professional to do it for you with accuracy.

We're here to help

If you are looking for a pro to help report your BOI, Gus and Violet with

Quint Tax Services Humboldt are here to help.

Inquire by calling or texting

(707) 986-8460 or

send us an email.